Written By: Crystal Parkinson, Utopia Mortgage LLC and member of CCAR's Affiliate Committee

If your clients are considering buying a home, they may be hesitant due to the current higher interest rates. However, waiting might not be the best course of action. In today's market, there are compelling reasons why now is a great time to make a move, even with higher rates.

- Negotiation Power in a Competitive Market Interest rates may be higher, but sellers are showing flexibility in their terms. Many are willing to contribute to closing costs or offer temporary interest rate buydowns, such as the 2-1 and 1-0 options. This provides buyers with an opportunity to secure a favorable deal and reduce their upfront costs. By leveraging these seller concessions, you can effectively mitigate the impact of higher interest rates, making their homeownership dreams more attainable.

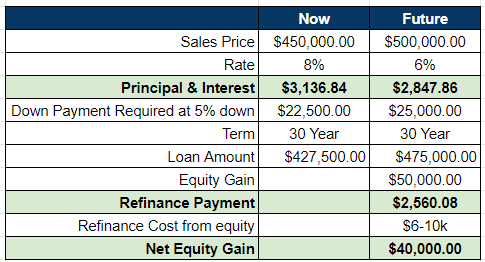

- Positioning for Future Savings One of the most compelling reasons to buy now is the potential for future savings. While rates may be higher today, they are not set in stone. Over the next 12 months, there is a chance that rates could decrease. If someone buys now at a great price and favorable terms, they will have the option to refinance when rates are more favorable. To do this, they will need to credit qualify again, and it's essential to have at least 5% equity in their home. This strategy allows someone to take advantage of current market conditions while keeping an eye on the potential for even more advantageous rates in the future.

- Beat the Rush and Rising Prices When rates eventually do go down, more buyers who have been on the sidelines will enter the market, and this influx can drive prices up. Waiting for rates to drop may seem like a safer option, but it could result in someone paying more for their dream home in the long run. By acting now, they can lock in a price that may be lower than what they would pay in a more competitive, rate-driven market, ensuring they get the best value for their investment. The opportunity for an “equity grab” is a nice benefit to buying now.

As shown in the graph above, buying now at a $450,000 sales price with an 8% interest rate can be more financially advantageous than waiting for rates to drop to 6% in one year with a $500,000 sales price. *PLEASE NOTE: These are not real rates. This is for logic purposes only in a hypothetical scenario that rates decrease.

In conclusion, while higher interest rates may be causing some hesitation in the real estate market, there are compelling reasons to buy a home now, rather than later. Sellers' willingness to negotiate terms, the potential for future refinancing savings, and the desire to secure your ideal home before prices rise are all solid reasons to take action. By considering the bigger picture and taking advantage of the current market conditions, you can help your clients make a strategic move that aligns with their long-term financial goals. Don't let them miss this golden opportunity in today's real estate market.